10 Best Credit Card in Singapore (Perks & Rewards) — When purchasing in-person or online, credit and debit cards often have the same features and seem to be equally simple and efficient to use. However, did you realize that these two cards actually have significant differences? According to this article by Investopedia, with a credit card, a person can borrow money from the financial institution that issued the card, which is commonly a bank. Cardholders agreed to pay back the money with interest in accordance with the institution’s rules.

In this system, there are three main categories of credit cards that can be used to earn rewards, reduce interest costs, and help the user build or rebuild their credit. This demonstrates the advantages of having a credit card.

10 Best Credit Card in Singapore (Perks & Rewards)

| Reward Credit Cards

*To earn points, miles, and cash back |

Cash-back Credit Cards

|

Travel Rewards Credit Cards

|

|

| Low-interest & Balance

Transfer Cards *To pay off debt & carry a balance |

|

| Credit-building Cards

*To improve your credit |

|

| Others |

|

If you’re still inexperienced and wondering which credit cards are ideal for your financial budget, check out our articles below to learn about the best credit cards in Singapore for you to use.

Side note: If you are currently in Singapore hunting for food and have a credit card but are unsure of where to spend it, read our articles on the

- 12 Best Hawker Centers in Singapore,

- the 25 Best Ice Cream Shops in Singapore

- the 22 Can’t-Miss Desserts in Singapore

to have a memorable time playing tourist in your own state.

Don’t worry, several of the shops accept credit cards as payment.

1. HSBC Advance Credit Card

Example of HSBC Credit Card in Singapore

(Photos from Singsaver)

Perks:

- With a minimum monthly spend of $2,000, this credit card offers up to 3.5 % cashback.

- Earn 1% HSBC Everyday + Cashback when you deposit new cash(min of 5 eligible transactions) into your HSBC Everyday Global account.

- Enjoy free access to the ENTERTAINER with the HSBC app, which offers more than 1,000 1-for-1 discounts on food, lifestyle, and travel across the world.

- If you’re a new customer, you may get up to S$200 cashback when you apply and spend at least S$500.

| Credit Card Type | Cashback/Dining Credit Cards |

| Features & Reward |

Monthly spend S$2,000 and below

Monthly spending above S$2,000

|

Protection

Exclusive Offer

|

Are you eligible?

- Minimum age of 21 years old

- A minimum annual income of S$30,000 (Singaporean/Salaried Permanent Resident)

- A minimum annual income of S$40,000 (Singaporean/Self-employed and Singaporean ex-pat)

2. Citi Cash Back Card

Example of Citi Bank Credit Card in Singapore

(Photos from Singsaver)

Perks:

- Up to 20.88% fuel savings at Esso and Shell, plus 8% cash back at other petrol stations worldwide.

- Up to S$1 million coverage when you charge your travel tickets to Citi Cash Back Credit Card.

- Welcome gift of S$300 cash back to the new cardholder.

- Refer a friend and get S$150 cash.

- Earned rewards never expire.

| Credit Card Type | Cashback/Dining Credit Cards |

| Features & Rewards |

|

Are you eligible?

- 21 years old and above

- Min. income S$30,000 (local/PR) or S$42,000 (foreigner) a year

- The basic fee of S$192.60 inclusive of GST

3. Standard Chartered Smart Credit Card

Example of Standard Chartered Credit Card in Singapore

(Photos from Singsaver)

Perks:

- Free annual fees and cash withdrawals.

- Exemption from the cash advance fee.

- Welcome gift of S$300 cashback and 3 months of Disney+ subscription

- Refer a friend and get S$128 cashback.

- 3-month interest-free installments with no processing expenses

| Credit Card Type | Cashback Credit Cards |

| Features & Rewards | E-commerce Purchase Protection

|

Are you eligible?

- Singaporean/PR: 21 – 65 years old & min. an annual income of S$30,000.

- Foreigners: 21 – 65 years old & min. an annual income of S$60,000/must hold a Singapore Employment Pass.

4. American Express Singapore Airlines KrisFlyer Credit Card

Example of American Express Credit Card in Singapore

(Photos from Money Smart)

Perks:

- Annual fee: GST-inclusive waived of S$176.55 for the first year.

- Annual supplementary card fee: S$53.50 (including GST) is waived for the first year.

- No transfer fee, hassle-free converting.

- Welcome gift: Earn 5,000 KrisFlyer miles the first time you charge your Card.

| Credit Card Type | Cash Back/Air Miles Credit Cards |

| Features & Rewards |

|

Are you eligible?

- Singaporean/PR: over 21 years old & min. an annual income of S$30,000.

- Foreigners: over 21 years old & min. an annual income of S$45,000.

5. CIMB World Mastercard

Example of CIMB Credit Card in Singapore

(Photos from Singsaver)

Perks:

- Annual fees: No annual fees for a lifetime + up to four additional cards with no annual fees.

| Credit Card Type | Cashback Credit Cards |

| Features & Rewards |

|

Are you eligible?

Application is only open to Singaporeans and Permanent Residents.

- 21 years old and above (supplementary: 18 years old)

- Min. annual income of S$30,000

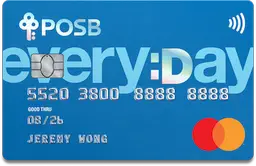

6. POSB Everyday Card

Example of POSB Credit Card in Singapore

Example of POSB Credit Card in Singapore

(Photos from Singsaver)

Perks:

- Annual fee: S$192.60 (First Year Fee Waiver).

- Supplementary card (annual fee): S$96.30 (First Year Fee Waiver).

- An all-in-one card for everyday purchases, bus/train rides, and ATM cash withdrawals.

- The earned cash rebates have no expiration date.

- First-time appliers will earn S4150 cashback.

- The cards may be used instantly on Apple Pay.

| Credit Card Type | Cashback/Dining & Groceries Credit Cards |

| Features & Rewards |

|

Are you eligible?

- 21 years old and above.

- Singaporean/PR: minimum annual income of S$30,000 and above.

- Foreigner: minimum annual income of S$45,000 and above.

7. DBS Live Fresh Card

Example of DBS Credit Card in Singapore

(Photos from Singsaver)

Perks:

- Annual fee: S$192.60 (First Year Fee Waiver).

- Supplementary card (annual fee): S$96.30 (First Year Fee Waiver).

- The first eco-friendly credit card in Singapore is made of 85.5% recycled plastic.

- Welcome gift for new cardholders: To be eligible for S$150 cashback, spend a minimum of S$800 within 60 days after card approval.

- Exclusive discounts and deals across fashion, dining, travel, and entertainment categories

| Credit Card Type | Cashback Credit Cards |

| Features & Rewards |

|

Are you eligible?

- 21 years old and above

- Singaporean/PR: minimum annual income of S$30,000 and above.

- Foreigner: minimum annual income of S$45,000 and above.

8. American Express Singapore Airlines KrisFlyer Ascend Credit Card

Example of American Express Credit Card in Singapore

(Photos from Singsaver)

Perks:

- An annual charge of S$337.05 (inclusive of GST)

- Earn up to 33,600 KrisFlyer miles when you pay the annual fee and make a S$3,000 purchase within the first 3 months of receiving your card.

- Get 5,000 KrisFlyer miles upon the first time charging the card (only for first-timer applicants).

- Receive 10,000 KrisFlyer miles after paying the Annual Fee and completing your first transaction within 30 days of receiving the Card.

| Credit Card Type | Cashback/Air Miles Credit Cards |

| Features & Rewards | Complete Fraud Protection Guarantee

Emergency Card Replacement 24-hour Customer Care Professional and Global Assist Local and worldwide acceptance |

|

Are you eligible?

- Singaporean/PR: over 21 years old & min. an annual income of over S$50,000 p.a.

- Foreigners: over 21 years old & min. an annual income of over S$60,000 p.a.

9. CIMB Visa Infinite Card

CIMB Credit Card in Singapore

(Photos from CIMB SG)

Perks:

- No annual fees are applied.

- Free up to 4 supplementary cards.

- Utilize CIMB Cash Advance to get additional cash.

- Convert the available credit limit on your CIMB Credit Card into cash at no interest

| Credit Card Type | Cashback Credit Cards |

| Features & Rewards |

|

Are you eligible?

Application is only open to Singaporeans and Permanent Residents.

- 21 years old and above (supplementary: 18 years old)

- Min. annual income of S$120,000

10. Maybank Family & Friends Card

Example of Maybank Credit Card in Singapore

(Photos from Singsaver)

Perks:

- Choose your favorite card design (for new card applicants).

- Annual fee: S$180.00 (First Three Years Fee Waiver).

- Supplementary card: No annual fee.

- Apply for a new Maybank Credit Card and charge a minimum of S$350 for each of the first two consecutive months after approval.

| Credit Card Type | Cashback Credit Cards |

| Features & Rewards | Earn 8% cashback on your top 5 chosen cashback categories from a choice of 10 possibilities.

Earn 0.3% cashback when paying AXS bills, with no minimum spending requirement. |

Are you eligible?

- 21 years old and above

- Singaporean/PR: Min. annual income of S$30,000.

- Malaysia citizen: Min. annual income of S$45,000, working for at least a year.

- Other nationalities: Min. annual income of S$60,000, working for at least a year.

FAQ on Credit Cards

- How do credit cards work?

Answer: Credit cards enable you to spend today and pay later when it comes time to settle your monthly bill. There will be a steep interest rate of about 25% per year if you don’t make the required monthly payment.

- How to choose the right type of credit card?

Answer: Select a credit card that best fits your lifestyle, allows you to pay it off each month without incurring debt, and provides you with the most rewards. Then, be sure to familiarize yourself with the interest rates, costs, perks, and promotional rates that offer the greatest value and fit your budget. The next step is to decide where or for what purpose you’ll utilize the card.

- Should I have a lot of credit cards?

Answer: You are free to apply for as many credit cards as you like. However, missing a payment might result in high-interest costs and ruin your credit record. Additionally, it will affect your credit limit the following time you apply for a credit card or loan facility. Therefore, be certain to consider your financial budget plan before you decide to apply.

- Should I still apply for a credit card if I don’t need to borrow money?

Answer: One of the most huge benefits of having a credit card is that any purchases above £100 are protected. This means that if your items do not arrive or are damaged, or if the seller goes bankrupt, your credit card company is jointly liable with the supplier, and you should earn your money back. Additionally, you may earn air miles, loyalty points, or cash back with a rewards credit card, which could result in cost savings.